It has generally turned to foreign currency swaps and repurchase agreements to affect the money supply and interest rates. The SNB does not base its monetary policy on a particular money market rate, in contrast to the majority of central banks. Having complete autonomy in determining monetary and exchange rate policy, it has created cutting-edge methods for controlling interest rates and managing liquidity. In the realm of central banking, the SNB, the Central Bank of Switzerland, occupies a special place. The exchange rate of the Swiss franc is guided by several factors. Switzerland offers investors a low-interest rate environment that helps investors to borrow in the Swiss franc and invest in high-return assets and other currencies worldwide. Although it is most frequently traded against the euro, the US dollar, the Japanese yen, and the British pound are some other common currencies it is traded with. Today, both the foreign exchange market and the futures market see regular trading of the Swiss franc. The CHF exchange rate and the price of gold were correlated until May 2000. Swiss francs were included in the system. The Swiss Franc was seen as a stable and secure currency, and it became a popular choice for international transactions.įollowing the Second World War, the Bretton Woods exchange rate system was designed, and it was in effect up until the early 1970s. Switzerland remained neutral during the war, and its banks became a safe haven for investors and governments seeking to protect their assets from the conflict. This union linked the values of all four countries' currencies to the value of silver.ĭuring World War II, the Swiss Franc played a crucial role in international finance. The Swiss franc was established at par with the French franc.īetween 1865 to the 1920s, France, Italy, Switzerland, and Belgium founded the Latin Monetary Union. The Federal Assembly established the Swiss franc as a monetary unit on May 7, 1850, and passed it as the first federal monetary law. In 1848, the new Swiss Federal Constitution stated that the federal government would be the only organization authorized to issue currency in the country. The cantons once again began issuing their own currencies, but the franc remained in use as a standard unit of exchange. However, the Helvetic Republic was short-lived, and in 1803, Switzerland regained its independence. As part of this effort, the Helvetic Republic introduced a new currency called the franc, which was based on the French franc. In 1798, the French revolutionary army invaded Switzerland and established the Helvetic Republic, a new state that aimed to centralize power and modernise the country. At the time, each canton had its own currency, and there was no standard unit of exchange across the country. The Swiss franc, also known as CHF, has a rich and fascinating history that can be traced back to the late 18th century when Switzerland was a confederation of independent cantons. That’s not all, it is also the second most valuable bill worldwide. The 1000-franc banknote is the highest circulated bill, at 61.1%. The most often used banknotes include 10 francs, 20 francs, 50 francs, 100 francs, 200 francs, and 1000 francs.ģ. CHF currency coins come in 5 francs, 2 francs, 1 franc (equal to 100 centimes), ½ francs (50 centimes), 20 centimes, 10 centimes, and 5 centimes in value.Ģ. Another symbol for the Franc is ‘Fr’.Įverything You Need To Know About The Switzerland Currency:ġ. The SwissĮconomy has been recognized as the safest economy in the world and thus, is often referred as a safe heaven.

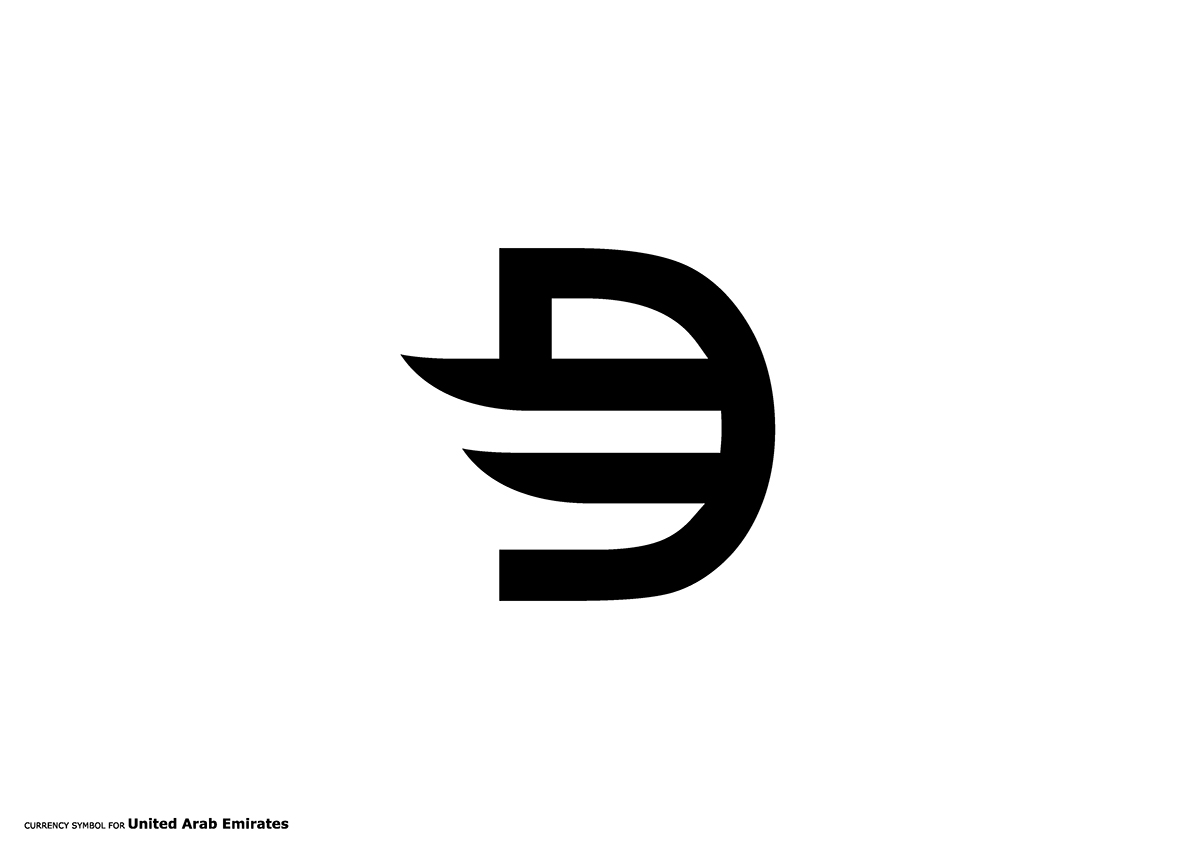

#Dubai currency symbol code

The currency code is CHF and the banknotes are issued by the Swiss National Bank, while the coins are issued by the Swiss Mint.

The Swiss Franc is the official currency of Switzerland. The non-refunded TCS will be reflected in the 26AS of the payer for claiming Income Tax credit. In the event of cancellation of services and refund of amount, Tax collected at source under section 206C(1G) of the Income Tax Act, 1961 shall not be refunded. The TCS collected will be reflected in the 26AS of the payer for claiming Income Tax credit. 7,00,000 in a financial year for remittance out of India under the Liberalised Remittance Scheme of the Reserve Bank of India. Further TCS under section 206C(1G)(a) of the Income-tax Act, 1961 at the rate of 5% will be collected if the aggregate amount exceeds Rs. Tax Collection at Source (TCS) at the rate of 5% will be levied under section 206C(1G)(b) of the Income Tax Act on outbound tour services. This blocked rate will be valid for 2 working days. You may block foreign currency by paying 2% of total transaction value.You can further add/edit travellers in preconfirmation page which can impact the total amount. This amount is calculated considering one traveller.

0 kommentar(er)

0 kommentar(er)